(Bloomberg) — China’s government plans to hold a meeting with key officials on Friday morning to discuss the property market, including a proposal to clear excess housing inventory, according to people with knowledge of the matter.

Most Read from Bloomberg

Senior officials from the housing ministry, financial regulators, local governments and state banks will attend the State Council meeting by video conference, the people said, asking not to be identified because the matter is private.

The breadth of invitees from across the government and the financial sector adds to signs that Chinese leaders are prioritizing efforts to end a property market slump that’s weighing on the world’s second-largest economy. Shares of Chinese developers jumped on Thursday after Bloomberg reported that China is considering a proposal to have local governments buy millions of unsold homes.

The State Council — China’s cabinet — is seeking to collect feedback from relevant parties by the end of this month and finalize a draft plan in June, the people added. The housing ministry didn’t respond to a request for comment.

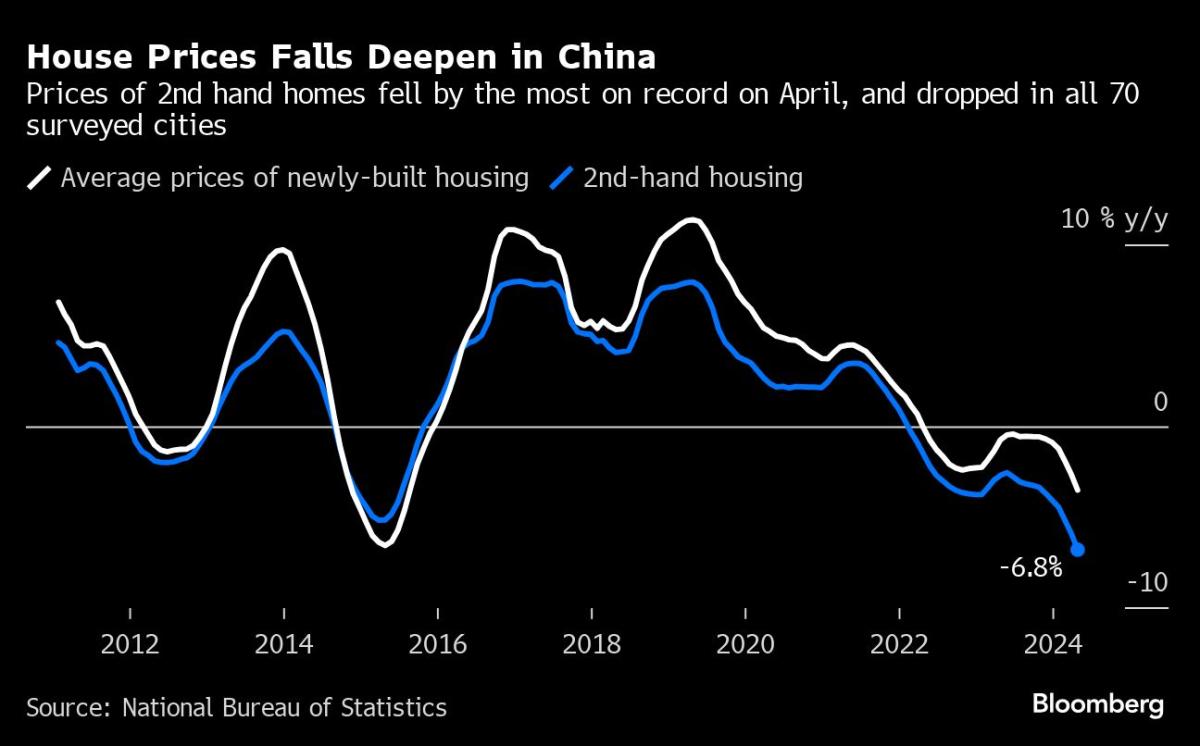

Spiraling declines in property prices are adding to the urgency. Official data Friday showed that home prices in April recorded the steepest month-on-month drops in a decade. New-home values slid 0.58% from March, while existing-home prices plunged 0.94%. From a year earlier, prices of new and used properties fell by a record.

Senior officials from the People’s Bank of China, the National Financial Regulatory Administration, the Ministry of Housing and Urban-Rural Development and the Ministry of Natural Resources will attend a briefing on Friday afternoon regarding the measures to ensure home delivery, according to a statement from the central bank.

Authorities will likely announce new policy measures to tackle the country’s persistent real estate crisis at a meeting scheduled for Friday morning, Caixin reported, citing unidentified sources. Officials will discuss ways to expand the so-called white-list of supported developments to include previously disqualified housing projects, according to Caixin.

Bloomberg reported on Wednesday that local state-owned enterprises would be asked to help purchase inventory from distressed developers at steep discounts using loans provided by state banks. Many of the properties would then be converted into affordable housing.

A Bloomberg gauge of Chinese real estate stocks rose as much as 7% in Friday morning trading, following an 11% gain on Thursday. The index has jumped more than 60% since mid-April on optimism that policymakers will take more steps to revive the market.

Among other recent measures, several large cities have removed restrictions on home purchases to rekindle demand. Homebuyers remain concerned about prices, job security and the ability of cash-strapped developers to deliver apartments.

If authorities proceed with the plan to reduce inventories, it would mark a new phase in the government’s campaign to address the biggest drag on economic growth. China’s home sales plummeted about 47% in the first fourth months and unsold housing inventory is hovering at an eight-year high, exacerbating a meltdown that threatens to put about 5 million people at risk of unemployment or reduced incomes.

China might need to spend at least 1 trillion yuan ($139 billion) to buy up unsold homes, Bloomberg Intelligence credit analysts Andrew Chan and Daniel Fan estimated. “Although several factors may affect the execution of this measure, any new policy is likely to be positive,” they wrote in a note.

Enlisting local governments to reduce the housing glut could further exacerbate their debt level, which has soared to 56% of gross domestic product as of last year. Banks would also be under pressure as their balance sheets have already been eroded by rising bad loans and narrowing margins.

(Updates with latest home-price data released Friday in the fifth paragraph, market reaction in the ninth.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.