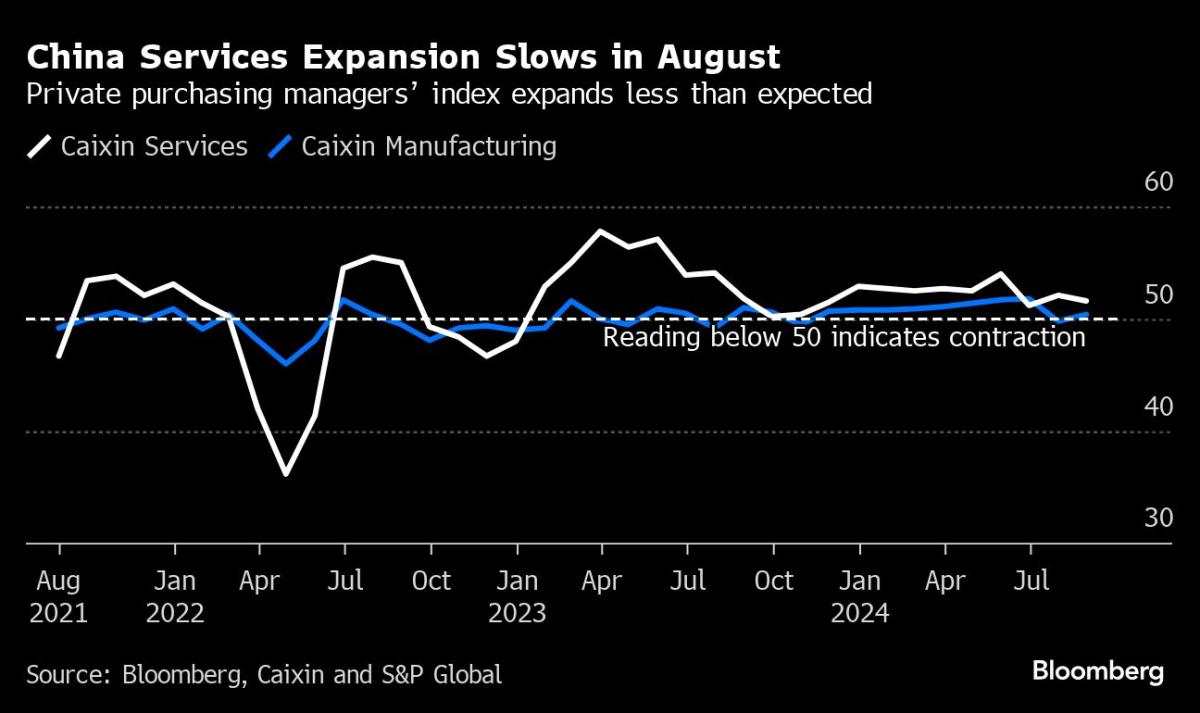

(Bloomberg) — China’s services activity expanded less than expected, a private survey showed, adding to worries over the economy’s health.

Most Read from Bloomberg

The Caixin China services purchasing managers’ index fell to 51.6 in August, compared with 52.1 the previous month, according to a statement released by Caixin and S&P Global on Wednesday. The median forecast of economists surveyed by Bloomberg was 51.8. Any reading above 50 suggests an expansion.

“Competition in the sector was still fierce, and boosting sales through price cuts became a priority for businesses,” Wang Zhe, senior economist at Caixin Insight Group, said in a statement. “Surveyed companies adopted a cautious approach to hiring to save costs, leaving the labor market under pressure.”

The findings add to a picture of an economy at risk of stalling, with official data published over the weekend showing service industries from restaurants to tourism near contraction during the last month of summer. The sector is at the center of piecemeal government action to revive consumer demand weighed down by a prolonged real estate crisis.

The International Monetary Fund has called services “an underutilized driver” of growth that contributes far less to China’s value-added than the advanced economy average of about 75%.

The onshore yuan pared a gain on the latest data, trading up 0.1% at 7.1138 per dollar as of 10:19 a.m. in Shanghai. The benchmark bond yield slipped one basis point to 2.13%, near the lowest in two decades.

The benchmark CSI 300 Index of Chinese shares retreated 0.5%, in line with a broad selloff in the region after a plunge in Nvidia Corp. shares fueled a rout in US equities.

The non-manufacturing measure of activity in construction and services eked out growth last month thanks to consumer appetite during the summer holiday season, the National Bureau of Statistics said on Saturday. Unlike the official services PMI, the Caixin survey focuses more on smaller private firms.

The outlook for the country’s $17 trillion economy still hinges largely on the prospects for manufacturing and exports even as new hurdles emerge to their expansion. China’s factory activity contracted for a fourth straight month in August, the latest sign the world’s No. 2 economy may struggle to meet this year’s growth target of around 5%.

–With assistance from Tania Chen and Zhu Lin.

(Updates with comment, markets reaction and chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.